If you were on Wall Street this past Friday, April 4, 2025, you would have experienced the kind of seismic tremor that turns a busy day in the office into a heart-pounding anticipation of a market maelstrom. Amidst the bustling affair, the Dow Jones Industrial Average experienced a jaw-dropping dive of over 2,200 points, which translates to a startling drop of nearly 5.5%. Similarly, the S&P 500 and the Nasdaq didn’t shy away from this dramatic plunge, each taking a nosedive close to 6%. The catalyst behind this colossal commotion? A fresh slew of tension stirred up by China, who decided to slap hefty new tariffs on American imports, and in doing so, sent shockwaves reverberating through financial streets and lanes not just at home, but globally.

For those of us living (and yes, investing) in the world of collectibles, particularly the booming realm of trading cards, this financial turmoil might ring a different kind of cash register—or perhaps not at all, depending on where you stand in your card-collecting convictions.

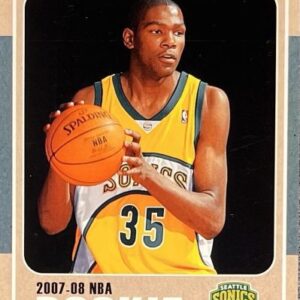

For the last several years, the trading card industry has been a veritable gold rush. What started as tokens of childhood nostalgia has morphed into an extravagant parade of skyrocketing values, all driven by waves of collectors and investors on the lookout for prime pieces. Names like Shohei Ohtani, Aaron Judge, and Mike Trout send shivers of anticipatory investment opportunity down the spines of serious card players—no pun intended. Rookie cards of these big names have shifted from the mire of shoebox keepsakes to headliners that make even the stock exchange curtsy.

Yet, every gold rush conceals a shadow—a reminder that what goes up can just as easily come crashing down. An economic downturn, such as the eye-watering drop of today, has a knack for reshaping consumer’s wallets. Confidence dips, and with it, the clasp on purses tightens. Suddenly, the allure of high-end collectibles might lose some of its shine if public spending undergoes its own recession. We might be on the cusp of witnessing the trading card market re-evaluate and recalibrate, as prices could soften in light of diminished consumer fervor.

Conversely, some intrepid investors might start scouting for silver linings in storm clouds. In times of market volatility, the allure of tangible assets has the uncanny ability to shine through like a lighthouse in trading fog. Trading cards, especially those of the rare and graded variety, could become surprising contenders in the realm of financial safe havens. The crash of yesterday’s market might just drive anxious investors into the open arms of a hobby where the value isn’t as tied down by the rigors of real-time market stats, but instead by scarcity, condition, and fandom.

Of course, between now and the time the financial storm clears—or intensifies—the trading card market is bound to experience its own whirlwind of fluctuating values and shifting collector priorities. Broad economic trends will play their part, but so will individual consumer confidence and the moods of the market. Collectors and investors with a sharp eye will need to scrutinize these rippling indicators as they evolve, adjusting their strategies to keep or reclaim the upper hand.

Whether this current financial hiccup in Wall Street will be a mere bump on the road or the early whispers of a more profound shift remains a puzzle that the future alone can unravel. Amidst numbers, figures, and collectible pieces, the shrewd collector will keep their gaze firmly on both the heart and the bottom line.

For now, while Wall Street works to patch its wounds from Friday’s debacle, those in the orb of the trading card industry should ready themselves for a ride that might twist and turn in unexpected ways. There’s much to anticipate—pitfalls, perhaps—but also rich opportunities for those who pay attention with both eyes open and sleeves rolled up, ready for what comes next in this fascinating intersection of finance and fandom.